The most common question we have received from doctors is, “What is my concierge practice worth?”

While the practice’s recent financial performance is a key variable, other variables also play a role. In fact, financial performance is often not the most important variable.

Concierge medical practices and Direct Primary Care practices are valued based on many factors. They include, but are not limited to:

- Age/history of the practice – How long has the practice been operating?

- Location

- Size of the practice

- Number of patients

- Number of employees

- Average annual patient fee

- How are patients billed? Annually, semi-annually, quarterly,

- Does the practice accept insurance?

- Patient turnover

- Services/products offered

- Potential for growth

- Recent financial performance

Interestingly, the doctor and the potential acquirer of the practice are both concerned about patients and what happens after the sale. The doctor wants to be assured that his/her patients will be properly cared for as they are accustomed to. The potential buyer wants assurances that most patients will stay on after the sale. When it comes to patients, the doctor and acquirer are aligned.

Herein lies what may be the most important factor when valuing a concierge or direct primary care practice: the doctor’s goals and objectives. If a doctor is looking to retire soon after the sale, the acquirer will likely ask the doctor to work for 60 to 120 days to help transition the practice (and maintain the patient panel). This scenario tends to be a drag on valuation. While the practice has good value, it will probably be at the lower end of the potential valuation range. These valuations can be lower, as the acquiring firm must invest in searching for a talented replacement physician, which can be challenging and costly in many cases.

If the doctor is willing to stay on for two years or longer, after the sale, this tends to increase valuation and move it towards the middle of a sliding scale. Under this scenario, the patients stay loyal, and the doctor is there to help the acquirer transition the practice.

If a doctor is willing to stay three to five years after the sale, this will tend to push valuation toward the upper limits. Why is that?

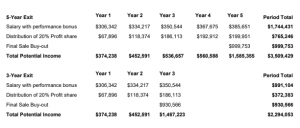

Some acquirers purchase 80% of the practice on day one. They then work with the doctor to grow the practice over a three- to five-year period. During that period, the doctor participates in the practice’s growth via annual profit share. At the end of that period, the acquirer will purchase the remaining 20% of the practice at a premium to the initial value of the practice.

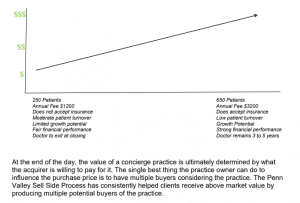

Because of all the factors listed above, it is difficult and potentially irresponsible to present a specific valuation or an asking price. When asked to value a practice, we request details for all this information and present a range of valuations rather than an absolute amount. The following chart illustrates the factors that affect valuation.

At the end of the day, the value of a concierge practice is ultimately determined by what the acquirer is willing to pay for it. The single best thing the practice owner can do to influence the purchase price is to have multiple buyers considering the practice. The Penn Valley Sell Side Process has consistently helped clients receive above market value by producing multiple potential buyers of the practice.

Here is an example of a practice valuation we recently sold. The practice had 600 patients (low turnover) and an annual fee of $1500. It accepted insurance and had the potential to grow through increased annual fees and the addition of products and services. The doctor was committed to staying three to five years. Cash at closing was $600K, and the remaining payout depended on a three—or five-year exit.