Once a business has operated for a number of years, it makes more sense to develop and maintain an exit strategy plan than a business plan…

The main goal of any exit strategy plan is to maximize value in the business/asset that’s been built.

- Business plans get you into business and keep you on track in the early years

- Exit plans get the business into the most valuable operating posture

- Should the opportunity arise, a company operating under a proper exit plan will garner a much higher value upon sale or major disposition of the business

The following are usually included in any exit strategy plan:

- Timeline to exit

- Value drivers

- Exit mechanism

- Acceptable deal structures

- Universe of potential buyers

- Modeling the business for exit

- Actionable initiatives based on timeline

- Expected valuation

The timeline to exit is usually expressed as a range and will determine what options are actionable.

- Short or no timeline

- Actionable options – limited to selling what is in place, with some minor modifications

- One year to sale

- Actionable options – restructuring and/or right-sizing the organization

- Develop a modified reporting structure

- Actionable options – restructuring and/or right-sizing the organization

- Years to sale

- Actionable options – Identify and prioritize initiatives

- Value the individual initiatives and their potential impact on the exit strategy

- Actionable options – Identify and prioritize initiatives

Owners must understand and embrace those aspects of the business most valued by buyers.

The list of value drivers include the following:

- Earnings

- Growth

- Recurring revenue

- Customer base – breadth and depth

- Revenues under contract

- Balance sheet

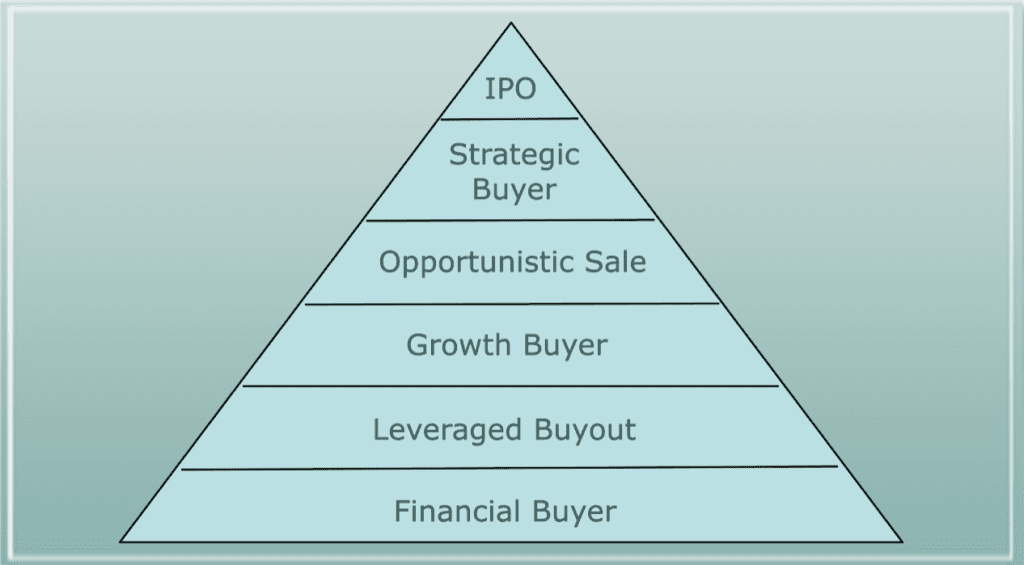

The Value Pyramid seeks to identify exit mechanisms in a hierarchy of probable $ outcomes.

Typical deal structure components include:

- Cash

- Stock

- Seller’s Note

- Earn-out

- Employment/consulting agreement

The Penn Valley database has about 200 potential buyers in the Converged Networking segment that include:

- Private Equity backed buyers

- Growth buyers

- Financial buyers

- Opportunistic buyers

Managing to the upward sloping earnings line:

- Right-sizing the business

- By line of business

- By geography

- Increase revenue/gross margin

- Decrease operating costs

Right-sizing the business

- Identify the General and Administrative expense structure that will support current business volumes

- Staffing levels to be adjusted according to business volumes, taking technical certifications into consideration

- Can be accomplished through an analysis of historical financials

- Translates into an optimal earnings model

- At the end of the day, its about earnings

Establish an acceptable valuation goal

- Goal should be owned by all stakeholders

- Goal should be realistic and achievable within agreed upon timeline

- Goal should assume most conservative exit mechanism

- Financial buyer – lowest multiple

- Assume a minimum earnings levels

- Combine to establish baseline valuation on buyout

Actionable initiatives should be defined by their contribution to gross margin within the specified timeline

- Define initiatives around existing strengths of the company

- Define initiatives based on gross margin and value drivers

- This exercise usually yields many potential initiatives that would contribute to the valuation goal

Actionable Initiatives

- Reduce costs

- Every $ reduction in G&A translates into $4 to $6.5 upon exit

- Increase sales

- Every $ increase in gross margin translates into $4 to $6.5 upon exit (assuming no change in G&A expense)

- Acquisition options

- Should not be ignored

- Can be used to bolster earnings in a highly leveraged way

Acquisition initiatives

- Can be significant contributor to sales/gross margin

- Consideration to geographic and product/service offerings

- Consideration to cumulative addition to EBITDA

- Example:

- $10M in sales

- $3.5M in gross margin

- $2.9M in G&A

- $600K in net income

- Potential to contribute up to $3.5M in EBITDA

- Potential contribution to valuation up to $18M

- Timeline and valuation expectations will drive strategy

- All stakeholders should be bought in

- Actionable initiatives (prioritized) will drive valuation

- Value Drivers should play a role in any exit strategy

- Acquisitions can be a powerful, low risk way to ratchet up earnings and valuation

- An opportunistic buyer can trump all